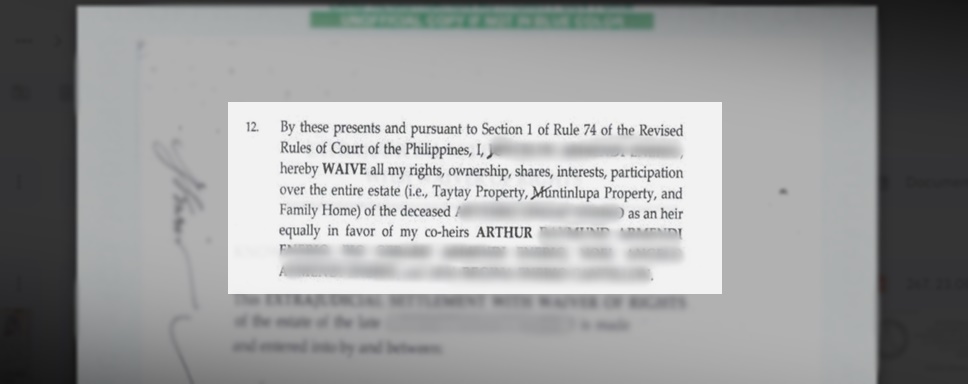

An Extrajudicial Settlement with Waiver of Rights is a notarized document signed by all heirs, where one or more heirs may decide to waive their claim to the estate. It allows the transfer of the deceased’s property to the heirs.

An EJS with Waiver of Rights has the same requirements and process as a regular EJS.

However, it differs in that donor’s tax may be applied depending on the situation:

In this article, we briefly go through the requirements and process of an EJS with Waiver of Rights but mostly focus on Donor’s tax.

Contact us for a consultation with an Inheritance Lawyer, if you need help.

The requirements for an Extrajudicial Settlement with Waiver of Rights are all the property documents, all the PSA documents, and the EJS itself.

To be clear, the requirements are:

· All PSA birth, death, marriage certificates and IDs of all the parties

· All property documents and their Certified True Copy such as Land Titles, Tax Declarations, Mortgages, Certificates of No Improvement, and a Certificate of Landholding for the deceased

· All titles for stocks, vehicles, etc.

· Notarized EJS with Waiver of Rights, signed by all heirs and authenticated as applicable.

Now, that sounds simple.

Families don’t have the documents, the documents have issues, or the heirs do not agree and won’t sign the EJS.

(And yes, all heirs have to agree and sign).

This can prevent an estate from ever being settled.

We discuss a lot of these common problems in our post on Extrajudicial Settlements.

Our article talks about these issues from a very, very practical standpoint so that you can be helped.

(It can take years to do an EJS if problems are encountered in the documents. Read the post – it will help. If you need personalized advice, you can always contact us later for an Inheritance Lawyer consultation).

Extrajudicial Settlement with Waiver of Rights follows the regular EJS process:

Because of the manual filing at the BIR and each pertinent location and because extra documents may be required at the BIR, please remember that the process can take longer than it looks.

Try to settle within a year or within the period, since afterward late fees are added every year on top of the BIR estate taxes.

And if there are applicable Donor’s Taxes, the Donor’s taxes must be settled within 30 days or face late fees as well.

An Extrajudicial Settlement waiver of rights can be subject to donor’s tax, depending on the situation on top of the BIR estate taxes, the Inheritance Lawyer fees, Documentary stamp tax, the transfer fees, the costs of getting the documents and the Accountant’s fees if applicable.

We’ve discussed many of these fees in our articles on Extrajudicial Settlements and BIR Estate taxes depth.

You’ll need to know about these BIR estate taxes since these are applicable in an EJS with Deed of Donation.

There is a significant difference between a regular EJS and an EJS with Waiver of Rights.

The Donor’s tax must be paid within 30 days of the notarization of the document.

If it is not paid, then the donor’s tax is subject to late fees.

I’ll be discussing donor’s tax further down below – specifically when it is applicable.

However, I find that specific examples help people understand better.

Let’s go through 4 specific scenarios below.

RMC 94-2021 discusses this in its very first line, “General renunciation of an heir on his share from the inheritance is not subject to Donor’s Tax.”

This is very pertinent for families where some heirs have long left the Philippines.

They sometimes completely waive their share of properties since they cannot administer them. This situation is applicable to them.

When an heir waives his share in favor of a specific heir, this transaction is subject to Donor’s tax.

Thus, this Extrajudicial Settlement with Deed of Donation would have both BIR Estate Taxes and Donor’s Tax.

If there are 3 properties and 3 children and the children choose specific properties, there is a donation when the value is in excess of the “should be” share of the inheritance.

In the example up top, each heir should get 2,083,333 of the estate.

However, 2 get more than that and one gets less since specific properties go to each heir.

So, in this specific Extrajudicial Settlement with Deed of Donation, there is Donor’s tax applicable.

An EJS with waiver of right highlighting the waiver of the surviving spouse" width="968" height="384" />

An EJS with waiver of right highlighting the waiver of the surviving spouse" width="968" height="384" />

A legal spouse waives his or her share of the inheritance and her part of the Conjugal Property in favor of her children.

If a parent passes away and the legal spouse decides to waive both his or her share of the inheritance and the share in the conjugal property in favor of their children, the donor’s tax is applied to the conjugal property donated.

I know that sometimes estate matters can be complicated but hopefully, this has cleared up a lot of your questions.

If your situation is complicated and you need personal advice, you can always contact us for a formal consultation with an Inheritance Lawyer.